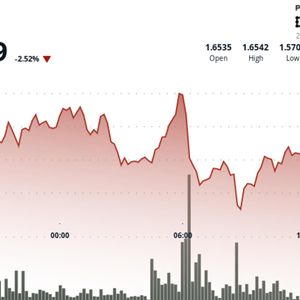

On Monday, US-based cryptocurrency exchange Coinbase (COIN) announced its tenth acquisition of the year, revealing plans to acquire The Clearing Company, a prediction market start-up. Coinbase Unveils Ambitious Plans The announcement comes on the heels of Coinbase unveiling its plans to launch a suite of new products aimed at transforming its platform into a comprehensive financial application. This initiative includes integrating stocks, advanced trading tools, and prediction markets into its services. CEO Brian Armstrong envisions Coinbase as a one-stop destination for a variety of trades, from stocks to streamlined futures and perpetual contracts, bolstered by a partnership with Kalshi that emphasizes prediction markets. The mainstream emergence of prediction markets during the 2024 US presidential race with platforms such as Kalshi and Polymarket taking the helm has sparked significant interest and investment across the broader financial sector. This trend is particularly timely as trading platforms are increasingly expanding their product suites to cover multiple asset classes, a necessary adaptation as competition intensifies in the industry. Analysts suggest that this shift could help Coinbase reduce its dependence on cryptocurrency trading, especially as new players enter the market. Prediction markets are expected to enhance engagement on the Coinbase platform, providing a high-frequency product that attracts users beyond traditional crypto transactions. Analysts from Benchmark highlighted this potential, noting that prediction markets could encourage greater user interaction with the app. Following the announcement, JP Morgan analysts remarked that many of the exchange’s new initiatives are designed to encourage customer engagement, an area that has seen limitations in the past. Although the terms of the transaction have not been disclosed, the deal for The Clearing Company — part of what Coinbase calls ‘the Everything Exchange’ — is expected to close in January 2026. Major Platform Overhaul Among its notable acquisitions this year, Coinbase previously agreed to acquire the derivatives exchange Deribit for $2.9 billion in May and later struck a deal for investment platform Echo, valued at approximately $375 million in October. Coinbase’s ambitions in trading do not stop with the acquisition of The Clearing Company. The exchange seeks to introduce its version of outcome trading as part of a broader push toward a unified brokerage service that combines traditional assets, derivatives, and blockchain capabilities. In line with this effort, the cryptocurrency exchange is launching “Coinbase Tokenize,” an institutional-grade infrastructure designed to facilitate the tokenization of real-world assets (RWAs). Beyond retail trading, Coinbase is also broadening its appeal to businesses and developers. The company has announced that Coinbase Business will now be accessible to qualifying customers in the US and Singapore, alongside an expanded API suite that includes services like custody, payments, trading, and stablecoins . Moreover, the firm plans to introduce “custom stablecoins” tailored for companies needing branded solutions. The exchange is also highlighting its x402 payments standard, aimed at streamlining stablecoin transactions associated with web requests. On Monday, the exchange’s stock, which trades under the ticker name COIN, closed the trading session at $247.90. Featured image from Shutterstock, chart from TradingView.com