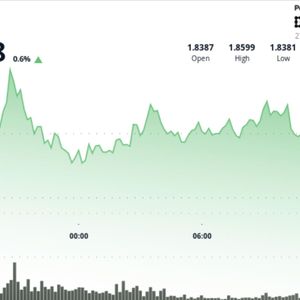

BitcoinWorld FLOW Suspension Crisis: South Korean Exchanges Halt Transactions Amid Security Fears In a significant move impacting the digital asset market, South Korea’s leading cryptocurrency platforms—Upbit, Bithumb, and Coinone—have simultaneously suspended all deposit and withdrawal services for the FLOW token, citing an urgent security review. This coordinated action, announced on March 21, 2025, immediately affects thousands of traders and raises critical questions about blockchain network integrity and exchange risk management protocols. Consequently, market participants now face frozen assets, while the broader industry scrutinizes the implications for investor protection. FLOW Suspension Details and Immediate Market Impact Upbit, Bithumb, and Coinone issued nearly identical statements regarding the FLOW suspension. They identified a potential security vulnerability requiring immediate investigation. Specifically, the exchanges halted all FLOW-related transaction services, although spot trading pairs remain active on their order books. This partial freeze allows users to trade FLOW against other cryptocurrencies but prevents any movement of tokens on or off the exchange platforms. Market data shows a swift reaction: the price of FLOW dipped approximately 7% across global markets following the announcement. However, trading volumes on the affected Korean exchanges plummeted by over 60% for FLOW pairs, indicating a sharp decline in market confidence. Meanwhile, other major global exchanges continue to process FLOW transactions normally, highlighting the localized nature of this security concern. The Flow Blockchain: Context and Previous Network Events To understand this event, one must examine the Flow blockchain itself. Developed by Dapper Labs, Flow is a proof-of-stake blockchain designed for scalability, particularly for NFTs and gaming applications. Major projects like NBA Top Shot and UFC Strike operate on its network. Historically, Flow has maintained a strong security record. However, in late 2023, the ecosystem faced a smart contract exploit in a third-party marketplace, not the core protocol. That incident resulted in a loss of roughly $500,000. The current exchange-led suspension appears unrelated to that past event but underscores the persistent vigilance required in decentralized ecosystems. Furthermore, exchanges often conduct these reviews proactively after receiving alerts from blockchain analytics firms or internal monitoring systems. South Korea’s Stringent Regulatory Environment This action exemplifies South Korea’s rigorous approach to cryptocurrency oversight. The nation’s Virtual Asset User Protection Act , fully enacted in 2024, mandates strict security and operational standards for exchanges. Under this law, platforms must implement real-time monitoring, maintain high reserve ratios, and report any suspicious activity to the Financial Services Commission (FSC) immediately. A coordinated suspension by the top three exchanges strongly suggests they are adhering to a regulatory guideline or responding to a formal advisory. For instance, in 2022, a similar multi-exchange suspension occurred for WEMIX tokens following a delisting decision by the Digital Asset Exchange Association (DAXA). This precedent shows that Korean exchanges frequently act in unison when perceived risks emerge. Deposit/Withdrawal Freeze: Transactions halted for security review; trading continues. Regulatory Compliance: Action aligns with South Korea’s strict Virtual Asset User Protection Act. Market Reaction: FLOW price dipped 7%; Korean exchange volume fell over 60%. Precedent: Follows pattern of coordinated exchange actions led by DAXA in South Korea. Expert Analysis on Exchange Security Protocols Security experts emphasize that such suspensions are a standard, albeit disruptive, risk management tool. “When an exchange detects anomalous network activity or receives a credible threat intelligence report, isolating the asset is the first line of defense,” explains Dr. Mina Choi, a cybersecurity researcher specializing in blockchain at Seoul National University. “This protects not only the exchange’s hot wallets but also prevents potentially compromised tokens from entering their system and affecting other users.” Dr. Choi further notes that the investigation will likely focus on several areas: the Flow core protocol’s consensus mechanism, known smart contracts on the network, and the integrity of the deposit address generation system used by the exchanges. The review timeframe typically depends on the complexity of the issue, with previous cases resolving within 48 hours to two weeks. Practical Implications for FLOW Holders and Traders For users on Upbit, Bithumb, and Coinone, the suspension creates immediate practical challenges. Holders cannot transfer FLOW tokens to private wallets for staking or to other exchanges, potentially missing out on yield opportunities or arbitrage. Traders engaging in cross-exchange strategies face interrupted workflows. The exchanges have advised users to monitor official announcements for restoration timelines. Crucially, funds remain secure in user accounts during the suspension. Historically, services resume fully once the security review concludes and any required node or wallet software updates are deployed. Users are cautioned against responding to phishing attempts that often surge during such events, with scammers posing as support staff offering “emergency withdrawal” services. Recent Major Exchange Suspensions in South Korea (2023-2025) Asset Exchanges Reason Cited Duration WEMIX Upbit, Bithumb, Coinone, Korbit Circulation Misreporting Permanent Delisting QTUM (2024) Upbit Wallet System Upgrade ~36 hours FLOW (Current) Upbit, Bithumb, Coinone Security Issue Review Ongoing Conclusion The coordinated FLOW suspension by Upbit, Bithumb, and Coinone underscores the proactive and security-first posture of South Korea’s regulated cryptocurrency landscape. While disruptive in the short term, such actions aim to safeguard user assets and maintain systemic integrity. The event highlights the critical intersection of blockchain network health, exchange operational security, and evolving regulatory frameworks. The resolution of this FLOW suspension will be closely watched, offering further insights into risk management best practices for the global digital asset industry. FAQs Q1: Can I still trade FLOW on Upbit, Bithumb, or Coinone? A1: Yes, spot trading of FLOW against other cryptocurrencies like KRW or BTC continues on the exchanges’ order books. Only the deposit and withdrawal functions are temporarily suspended. Q2: Is my FLOW token balance safe on the exchange during the suspension? A2: According to exchange announcements, user balances remain secure and unaffected. The suspension is a preventive measure, not an indication of a breach of the exchange’s own wallets. Q3: What could be the specific security issue with FLOW? A3: Exchanges have not released details to prevent exploiting the vulnerability. Potential issues range from a concern with the Flow network’s node software to a flaw in how exchanges generate deposit addresses for the token. Q4: How long do such suspensions typically last? A4: Based on historical precedents in the Korean market, security reviews can last from a few days to two weeks. The duration depends on the complexity of the issue and the coordination required for a fix. Q5: Does this affect FLOW transactions on other global exchanges or decentralized platforms? A5: No, this suspension is specific to the three named South Korean exchanges. Transactions on other centralized exchanges (like Binance or Kraken) and decentralized platforms interacting directly with the Flow blockchain continue as normal. This post FLOW Suspension Crisis: South Korean Exchanges Halt Transactions Amid Security Fears first appeared on BitcoinWorld .