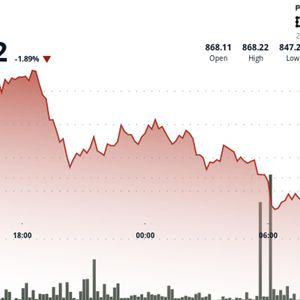

As crypto staking shifts from a niche activity to a mainstream practice, long-standing gaps in U.S. tax policy are coming under closer scrutiny in Washington, with lawmakers warning that unclear and inconsistent rules could discourage participation in blockchain networks and complicate compliance for millions of investors. Related Reading: Bitcoin Long-Term Holders Stay Resilient, But Profits Haven’t Fully Arrived – Here’s What To Know With the 2026 tax year nearing, 18 bipartisan House lawmakers have urged the Internal Revenue Service to review staking tax guidance, arguing it results in double taxation, creating administrative burdens and failing to reflect actual economic gains, especially during volatile markets. Lawmakers Press IRS Ahead of 2026 In a letter led by Representative Mike Carey , lawmakers asked whether any administrative barriers stand in the way of updating staking guidance before the end of the year. They argue that taxing rewards only at the point of sale would better capture actual economic gain while reducing reporting complexity. The group also warned that current rules may discourage staking participation, which plays a critical role in securing proof-of-stake blockchains and maintaining network resilience. The timing is deliberate. Several tax provisions are set to expire in 2026, and lawmakers want clarity on staking before broader tax debates take precedence. They also noted that prolonged uncertainty could invite unfavorable court rulings that lock in interpretations through precedent rather than policy. The PARITY Act and Broader Crypto Tax Reform Alongside the IRS letter, Representatives Steven Horsford and Max Miller have introduced a discussion draft known as the Digital Asset PARITY Act . The proposal takes a wider view of crypto taxation, including a de minimis exemption for regulated stablecoin payments used in everyday transactions. Small gains or losses from these payments would generally not be taxed, mirroring existing treatment for low-value foreign currency exchanges. For staking and mining, the PARITY Act stops short of eliminating immediate taxation but proposes allowing taxpayers to defer income recognition for up to five years. Supporters say this could provide interim relief while lawmakers work toward permanent clarity. The bill also extends wash-sale rules and certain securities tax provisions to actively traded digital assets, aiming to curb abuse without expanding loopholes. What Comes Next for Crypto Investors Together, these efforts signal growing consensus in Congress that crypto taxation needs refinement rather than piecemeal fixes. While no changes are guaranteed, the push to address staking double taxation reflects a shift toward more technical, outcome-focused policymaking. Related Reading: XRP ETFs Attract Global Pension Funds And Insurers, Canary CEO Reveals For investors and network participants, the next year could determine whether staking remains burdened by uncertainty or moves toward a clearer, more predictable tax framework. Cover image from ChatGPT, ETHUSD chart from Tradingview