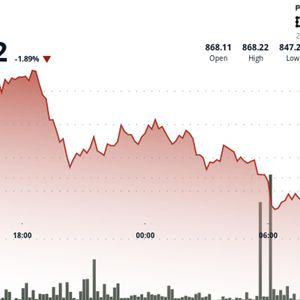

Bitcoin treasury company Strategy hasn’t announced any new BTC buy this week, but it has made an expansion to its recently-created USD reserve. Strategy’s USD Reserve Now Stands At $2.19 Billion As announced by Strategy co-founder and chairman Michael Saylor in an X post , the company has increased its US Dollar (USD) reserve by $748 million. Strategy first created the USD Reserve at the start of December, allocating $1.44 billion to it. During the announcement of the reserve, Saylor noted, “we believe it will better position us to navigate short-term market volatility while delivering on our vision of being the world’s leading issuer of Digital Credit.” The reserve’s existence didn’t mean that the firm paused Bitcoin acquisitions, as it made a purchase alongside the establishment of the USD reserve itself and on the two Mondays that followed. The Bitcoin purchase that came alongside the announcement was relatively small, but the two in the following weeks were some of the biggest of the year, each adding nearly $1 billion in tokens to the company’s treasury. The latest addition to the USD reserve, however, has come without a BTC purchase from Strategy. According to the filing with the US Securities and Exchange Commission (SEC), the firm funded the expansion using sales of its MSTR at-the-market (ATM) stock offering. Strategy’s USD reserve now holds around $2.19 billion, while its Bitcoin treasury is unchanged from last week’s figure of 671,268 BTC (worth $60.24 billion at the current exchange rate). Just like how BTC buys from Strategy usually precede a Sunday X post from Saylor with an image of the company’s portfolio tracker, the same tradition appears to be forming for USD reserve expansions as well. Before the initial announcement, Saylor made the portfolio tracker post with the caption: “What if we start adding green dots?” The chairman usually uses “orange dots” when referring to BTC, so this immediately hinted that something new was brewing. “Green dots” turned out to be additions to the USD reserve. The Sunday post before the latest purchase also used the same terminology, as Saylor said, “Green Dots ₿eget Orange Dots.” Strategy continues to be by far the biggest Bitcoin treasury company in the world, as data from BitcoinTreasuries.net shows. Strategy isn’t the only cryptocurrency treasury firm that has made an announcement on Monday. Bitmine has also shared a new press release with an update for its Ethereum holdings. Originally a mining-focused company, Bitmine pivoted to an ETH treasury strategy in mid-2025. Since then, the firm has been an active buyer of the cryptocurrency and has established itself as the largest digital asset corporate holder behind Strategy. Bitmine added 98,852 ETH (around $300.75 million) during the past week and now holds 4,066,062 ETH ($12.37 billion), equivalent to 3.37% of the asset’s total supply in circulation. “We are making rapid progress towards the ‘alchemy of 5%’ and we are already seeing the synergies borne from our substantial ETH holdings,” said Tom Lee, Bitmine chairman. BTC Price At the time of writing, Bitcoin is floating around $89,700, up almost 4% in the last seven weeks.