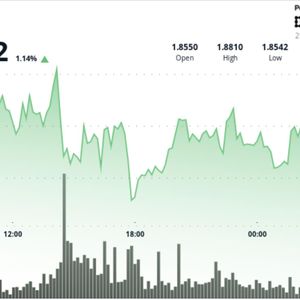

Russia’s central bank has unveiled a new framework to regulate cryptocurrencies within its domestic digital asset market, with a deadline set for July 2026. This initiative aims to enable both retail and qualified investors to purchase cryptocurrencies. New Crypto Regulations In Russia According to a Bloomberg report , non-qualified investors will be permitted to buy the most liquid cryptocurrencies after successfully passing a knowledge assessment. However, their transactions will be limited to 300,000 rubles, roughly equivalent to $3,800 annually, and must be conducted through a single intermediary. In contrast, qualified investors will have the freedom to purchase unlimited amounts of any cryptocurrency, aside from anonymous tokens, although they too will have to pass a risk-awareness evaluation. Despite these regulatory steps, the Bank of Russia maintains a cautious stance towards cryptocurrencies, categorizing them as high-risk assets . The central bank has urged potential investors to consider the significant risk of losing their funds. Transactions will occur through already licensed entities such as exchanges, brokers, and trust managers, while additional requirements will apply to custodians and exchange services. Moreover, Russian residents will be able to buy cryptocurrencies abroad and transfer their holdings through licensed intermediaries within the country, with obligatory tax reporting requirements . Bitcoin’s Role In Strengthening The Ruble This regulatory shift follows President Vladimir Putin’s remarks last year regarding the potential use of Bitcoin (BTC) and the need for Russia to rethink its reliance on foreign currency reserves. Speaking at an investment conference in Moscow, Putin highlighted the geopolitical issues stemming from the West’s freezing of around $300 billion in Russian reserves due to the ongoing conflict in Ukraine. He questioned the prudence of holding state reserves in foreign currencies, considering how easily these assets can be confiscated for political reasons. In a significant development, Putin has also signed a law that creates a legal framework for taxing Bitcoin mining and transactions, officially classifying them as property. This new law recognizes digital currencies as property and encompasses those utilized for foreign trade settlements within the Experimental Legal Regime (EPR) designed for digital innovation. Notably, the legislation stipulates that Bitcoin mining and sales will be exempt from value-added tax (VAT), potentially spurring further investment in the cryptocurrency market. Recently, Central Bank Governor Elvira Nabiullina made an unexpected acknowledgment regarding Bitcoin mining, noting its small yet meaningful impact on supporting the Russian ruble. While she admitted that quantifying this influence is challenging, Nabiullina suggested that mining has emerged as an “additional factor” contributing to the currency’s recent strength—a noteworthy admission from a central banker traditionally cautious about the crypto landscape. When writing, Bitcoin was trading just above the $88,090 mark, recording losses of 1.5% in the 24-hour time frame. Featured image from DALL-E, chart from TradingView.com