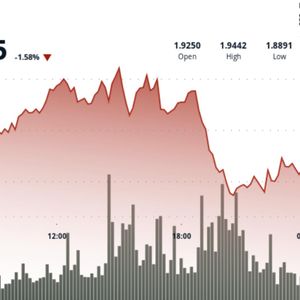

BitcoinWorld Shocking Loss: Justin Sun’s Frozen WLFI Holdings Plummet by $60 Million In a stunning turn of events, Tron founder Justin Sun faces a massive financial setback. Reports confirm his frozen World Liberty Financial (WLFI) holdings have lost a staggering $60 million in value. This dramatic loss highlights the intense risks and regulatory scrutiny within the cryptocurrency market. What Happened to Justin Sun’s Frozen WLFI Holdings? The crisis began when the World Liberty Financial team froze Justin Sun’s assets in September. This action came after he transferred approximately $9 million worth of WLFI tokens to another address. The team cited suspicions of market price manipulation as their primary reason for the freeze. Consequently, the value of his initial $75 million investment, made between November 2024 and January 2025, has now cratered. Why Won’t World Liberty Financial Unfreeze the Assets? The stance from World Liberty Financial is firm and clear. They have stated they will not release Justin Sun’s frozen WLFI holdings. Their decision stems from a commitment to protect their ecosystem and other investors. They believe unfreezing the assets could undermine market integrity. This situation raises critical questions about governance and power within decentralized projects. Key points from their position include: Suspected Manipulation: The team alleges actions intended to artificially influence the WLFI token price. Protocol Enforcement: They are enforcing their own rules to maintain project stability. Precedent Setting: This move signals a tough stance against perceived market abuse by large holders, or ‘whales’. How Does This Impact the Broader Crypto Market? This incident is not just about one investor’s loss. It serves as a cautionary tale for the entire cryptocurrency sector. It underscores the complex relationship between project teams and large-scale investors. Furthermore, it shows how quickly value can evaporate when assets are locked and sentiment sours. The fallout from Justin Sun’s frozen WLFI holdings may lead to: Increased scrutiny of whale activity and token vesting schedules. More robust clauses in project whitepapers regarding asset freezes. A reassessment of risk by large investors when engaging with new crypto projects. What Can Investors Learn From This Saga? For everyday crypto investors, this drama offers vital lessons. First, it emphasizes that even prominent figures like Justin Sun are not immune to severe losses. Second, it highlights the importance of understanding a project’s governance rules before investing. The power a development team holds can be substantial. Actionable insights include: Research Governance: Always review a project’s terms regarding asset locking and team authority. Diversify Risk: Avoid concentrating too much capital in a single, speculative asset. Monitor Whale Activity: Large transactions can signal both opportunity and impending volatility. Conclusion: A $60 Million Warning to the Crypto World The tale of Justin Sun’s frozen WLFI holdings is a powerful reminder of cryptocurrency’s volatile and unpredictable nature. It demonstrates that market rules are still being written and enforced, often in real-time. While Sun’s loss is monumental, the broader lesson on regulatory risk, project autonomy, and investment due diligence resonates for all market participants. The market watches closely to see if this establishes a new precedent for handling disputes between projects and their largest backers. Frequently Asked Questions (FAQs) Q1: Why were Justin Sun’s WLFI holdings frozen? A1: The World Liberty Financial team froze the assets in September after Sun transferred $9 million worth of tokens. They suspected these moves were an attempt to manipulate the WLFI token’s price. Q2: How much did Justin Sun initially invest in WLFI? A2: Justin Sun purchased a total of $75 million worth of WLFI tokens between November 2024 and January 2025. Q3: What is the current status of the frozen holdings? A3: The holdings remain frozen, and the World Liberty Financial team has stated they will not unfreeze them. Their value has dropped by approximately $60 million since the freeze. Q4: What does ‘price manipulation’ mean in this context? A4: It typically refers to actions designed to artificially inflate or deflate a token’s market price for personal gain, misleading other investors about its true supply, demand, or value. Q5: Can Justin Sun legally challenge the freeze? A5: This depends on the legal jurisdiction, the terms of service of the WLFI project, and the specifics of the purchase. Such challenges in the decentralized crypto space are often complex and unprecedented. Q6: How does this affect other WLFI investors? A6: The event has likely caused significant price volatility and shaken investor confidence. It also sets a governance precedent for how the project team handles disputes with large stakeholders. Found this deep dive into Justin Sun’s frozen WLFI holdings insightful? The crypto landscape moves fast, and knowledge is power. Share this article with your network on Twitter, Telegram, or Reddit to spark a conversation about investor protection and project governance in the digital asset space. To learn more about the latest cryptocurrency regulatory trends, explore our article on key developments shaping crypto market oversight and institutional adoption. This post Shocking Loss: Justin Sun’s Frozen WLFI Holdings Plummet by $60 Million first appeared on BitcoinWorld .

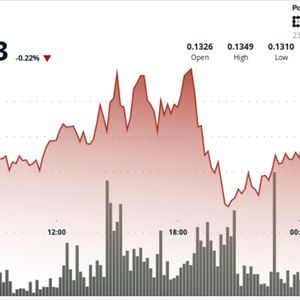

![[LIVE] Crypto News Today: Latest Updates for Dec. 23, 2025 – Trump Token is Down 21% This Month as Multiple Altcoins Hit Fresh Lows [LIVE] Crypto News Today: Latest Updates for Dec. 23, 2025 – Trump Token is Down 21% This Month as Multiple Altcoins Hit Fresh Lows](https://resources.cryptocompare.com/news/52/56213761.jpeg)