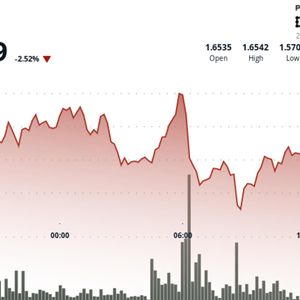

Bitcoin’s price has shown signs of structural weakness after breaking below its long-term bull market channel. The asset has since struggled to regain momentum, facing repeated rejections at key resistance levels. As the market enters the final stretch of 2025, questions remain about whether BTC can recover or if more downside is on the way. BTC Trades Below Long-Term Bull Channel Bitcoin has now spent six weeks below the bull market channel it had respected for nearly two years. During this period, the price made three attempts to re-enter the structure. All of them were rejected, with resistance now forming along the lower boundary of the previous trend channel. At present, BTC is consolidating just under this resistance area, suggesting that a fourth attempt to rejoin the channel may be possible. According to Titan of Crypto – a popular analyst with thousands of followers on X, how the market reacts from here could determine whether the recent move was a short-term deviation, a retest from below, or the beginning of a longer downward move. #Bitcoin It’s been 6 weeks since #BTC broke below its bull market channel. Price attempted 3 re-entries, all rejected. A 4th attempt remains possible. The real question is how this break below the channel resolves: – deviation – retest from below – or full reintegration pic.twitter.com/IeNYBqBSj0 — Titan of Crypto (@Washigorira) December 22, 2025 Moreover, Crypto analyst Crypto Tice has pointed to similarities between Bitcoin’s 2025 price action and the topping pattern seen in 2021. In both cases, the asset exhibited a rounded top, followed by a sharp decline, a subsequent bounce, and then ongoing pressure. “ This bounce isn’t strength by default, ” said the analyst, noting that it’s historically the point where “ positioning changes hands .” He added that while a push toward the $100,000–$105,000 range is still possible, that level has “ never been about celebration ” and could mark a turning point in sentiment. In 2021, a similar structure led to a deeper correction. The current support level being tested was also present in that cycle, and a breakdown from it eventually triggered a sharp move lower. Diverging Analyst Views on What Comes Next Trader Tardigrade has pointed to a potential bearish pennant formation on the weekly chart, suggesting a possible move toward $60,000. This structure, if confirmed, could extend the ongoing bear market, which began in September. Meanwhile, VanEck has reported a decline in Bitcoin’s network hashrate of around 4% as of mid-December. This drop in mining activity has previously occurred near market bottoms. Some see it as a possible contrarian signal, though it remains uncertain if this trend will repeat. Bitcoin is priced at around $87,100 at press time, down 2% in the last 24 hours but up 2% over the past seven days. As reported by CryptoPotato , the fourth quarter of 2025 is set to close with a 22% decline, the weakest Q4 since the 2018 market cycle. The post Is the Bitcoin Price at Risk of Falling Further? Market Faces Critical Test Below Bull Channel appeared first on CryptoPotato .