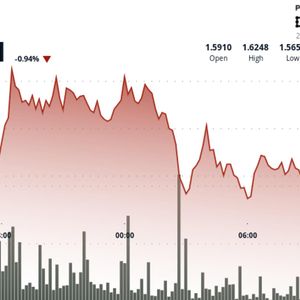

Amplify ETFs has launched two new funds targeting investors seeking to tap into the technology behind stablecoins and tokenization, two rapidly growing sectors of the digital finance industry. *]:pointer-events-auto scroll-mt-[calc(var(--header-height)+min(200px,max(70px,20svh)))]" dir="auto" data-turn-id="request-WEB:479afcf8-8f70-4f21-93ba-ff97999efdbe-40" data-testid="conversation-turn-20" data-scroll-anchor="true" data-turn="assistant"> The offerings include the Amplify Stablecoin Technology ETF (STBQ) and the Amplify Tokenization Technology ETF (TKNQ), among the first ETFs specifically focused on these segments of the blockchain market. *]:pointer-events-auto scroll-mt-[calc(var(--header-height)+min(200px,max(70px,20svh)))]" dir="auto" data-turn-id="request-WEB:479afcf8-8f70-4f21-93ba-ff97999efdbe-41" data-testid="conversation-turn-22" data-scroll-anchor="true" data-turn="assistant"> Investors are showing strong interest, as both funds tap into themes appealing to both institutional and retail audiences. STBQ and TKNQ launch amid clearer regulatory guidance and growing demand for thematic exposure beyond traditional cryptocurrencies, such as Bitcoin and Ethereum. ETFs broaden access to booming crypto infrastructure The Stablecoin Technology ETF (STBQ) is designed to track the MarketVector Stablecoin Technology Index, which comprises approximately 24 assets spanning equities and crypto-linked exposure related to stablecoin infrastructure and applications. Stablecoins are blockchain-based tokens typically backed by traditional assets, which limits their price swings. Their relative stability supports high-volume transactions, making them a key component of trading, payments, and decentralized finance (DeFi). STBQ targets companies and digital assets that generate a substantial share of their revenue from payment technology, digital asset infrastructure, and trading platforms, enabling investors to trace the firms at the center of stablecoin adoption, Amplify notes. Structured as a diversified portfolio, the fund offers growth potential in numerous new asset front-runner companies that are also leveraging blockchain-based solutions to augment exchange traffic throughput. Both ETFs have an expense ratio of around 0.69%, which is typical for other thematic and niche investments. Innovation is powered by regulation and market movements There’s a bigger game going on with the timing of these launches, and it’s as much a commentary on the timing of when regulations and markets are changing more generally. In the US, regulators have taken significant steps to address the treatment of digital assets, particularly stablecoins, which has given institutions the confidence they need to get involved in the space. It describes stablecoins laws, such as the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, and EU regulatory systems, like MiCA , as supporting factors for industry growth. That regulatory clarity has led legacy financial companies — from major payment networks to asset managers — to develop their digital asset services. Companies like Visa , Mastercard, Circle, and PayPal — all connected to payments or stablecoin work — would be part of the universe STBQ is working to track. Similarly, large financial institutions and exchanges, such as BlackRock, JPMorgan, Citigroup, and Nasdaq, have repositioned themselves in tokenization projects over the past few years, indicating an interest in a broader market for digital assets that can represent real assets. The newly released ETFs are among Amplify’s recent lineup entries as it seeks to expand the categories of products that investors can select in pursuit of emerging trends in digital finance. As international trading systems utilize blockchain for payments and tokenization, as well as for investing in financial infrastructure, STBQ and TKNQ could attract those looking to capitalize on long-term trends disrupting conventional trading in traditional funds. Sign up to Bybit and start trading with $30,050 in welcome gifts