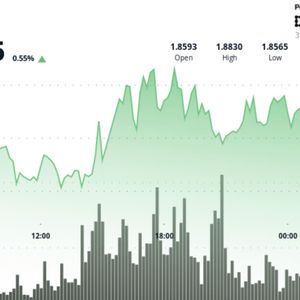

Bitcoin continues to struggle below the $90,000 mark, reflecting a market that has failed to recover bullish momentum after weeks of consolidation. Repeated attempts to reclaim higher levels have stalled, reinforcing growing skepticism among analysts who now openly discuss the risk of a broader bear market extending into 2026. Sentiment remains fragile, dominated by caution and reduced risk appetite, as traders wait for clearer confirmation of the next directional move. Related Reading: XRP Selling Pressure Returns: Investors Shift From Holding to Distribution Still, not everyone is convinced the bullish cycle is over. Some investors argue that Bitcoin is entering a transitional phase rather than a full trend reversal. According to on-chain analyst Axel Adler, the current setup in Bitcoin’s “Supply in Profit” metric offers important context. Adler highlights that Supply in Profit has fallen sharply from October peaks above 19 million BTC to roughly 13.5 million BTC following the correction from all-time highs. This decline pushed the short-term 30-day moving average well below the 90-day average, creating a gap of around 1.75 million BTC. While a similar configuration appeared in 2022 before an extended bearish period, Adler notes a key difference this time: the 365-day moving average remains historically elevated. Importantly, the 30-day average appears to have formed a local bottom in mid-December and is beginning to stabilize. Adler argues that if Bitcoin can hold current price levels or higher, this stabilization could mark the early groundwork for a renewed bullish phase later in 2026. Supply in Profit Signals a Critical Inflection Window Axel Adler also shared a forward-looking forecast chart tracking the convergence between the 30-day and 90-day moving averages of Bitcoin’s Supply in Profit metric, offering a potential roadmap for the next structural shift. The model extrapolates current rates of change to estimate when a bullish configuration—defined by SMA 30 crossing above SMA 90—could emerge. According to Adler’s analysis, the gap between these two moving averages is currently narrowing at a pace of roughly 28,000 BTC per day. Importantly, this convergence is not being driven by a sharp recovery in Supply in Profit, but by a mechanical decline in the SMA 90. As peak October values, when Supply in Profit reached 19–20 million BTC, roll out of the 90-day calculation window, downward pressure on the longer average creates a temporary “tailwind” for convergence. This effect is expected to persist through late January. If current conditions hold, Adler projects a potential bullish cross forming between late February and early March. However, the forecast remains highly price-sensitive. Supply elasticity to price is estimated at 1.3x, meaning a 10% price decline could trigger a 13% drop in Supply in Profit. The $70,000 level is critical according to the forecast. Below it, SMA 30 would likely fall faster than SMA 90, invalidating the convergence thesis and reopening a 2022-style prolonged recovery scenario. Related Reading: Chainlink Shows Strong Accumulation Signal: LINK Exchange Liquidity Dries Up Bitcoin Price Struggles Below Key Resistance Bitcoin continues to trade below the $90,000 threshold, reflecting a market that remains structurally weak despite short-term stabilization. The chart shows BTC consolidating after a sharp breakdown from the $100,000–$105,000 region, a move that decisively flipped prior support into resistance. This rejection marked a clear loss of bullish control and initiated a deeper corrective phase. Price now compresses below the downward-sloping 50-day and 100-day moving averages.. This configuration reinforces the prevailing bearish trend and suggests that upside attempts are likely to face supply pressure. The 200-day moving average, currently well above spot price, highlights how far BTC has drifted from its longer-term trend equilibrium. Related Reading: Why $100,000 Is Bitcoin’s Most Important Resistance Level Momentum has cooled notably since the November sell-off. While selling intensity has eased, the absence of strong bullish volume indicates that buyers remain cautious. The recent price action resembles a consolidation range rather than a reversal, with BTC oscillating between roughly $85,000 and $90,000. This behavior often reflects indecision rather than accumulation. For now, $90,000 remains the critical level bulls must reclaim to shift sentiment meaningfully. Failure to do so keeps downside risks in play, with $85,000 acting as near-term support. Until price regains key moving averages, the broader structure favors continued range-bound or corrective price action. Featured image from ChatGPT, chart from TradingView.com