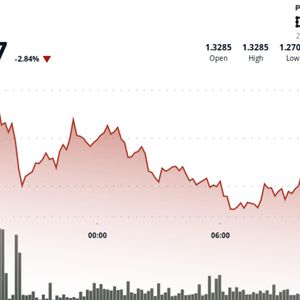

Summary Corporations buy the dip as ETPs fade: While Bitcoin ETP investors retreated, DATs stepped in, adding 42k BTC (their largest accumulation since July 2025). Miner capitulation may signal a bottom: The network hash rate dropped 4% (sharpest since April 2024), historically a bullish contrarian signal. The "diamond hands" divergence: Medium-term holders (1-5y) are selling, while long-term holders (>5y) remain unmoved. Under our GEO framework, Bitcoin shows weak onchain activity but improving liquidity conditions and a reset in speculative leverage, pointing to cautious optimism beneath the selloff. The GEO (Global Liquidity, Ecosystem Leverage, Onchain Activity) Framework to Assess Bitcoin's Price Potential Source: Bloomberg as of 12/17/2025. Past performance is no guarantee of future results. The information, valuation scenarios, and price targets in this blog are not intended as financial advice or any call to action, a recommendation to buy or sell, or as a projection of how bitcoin will perform in the future. Actual future performance of bitcoin is unknown, and may differ significantly from the hypothetical results depicted here. There may be risks or other factors not accounted for in the scenarios presented that may impede the performance. These are solely the results of a simulation based on our research, and are for illustrative purposes only. Please conduct your own research and draw your own conclusions. GEO is our qualitative framework that scores three key pillars of the Bitcoin ecosystem to cut through daily price noise and assess the structural health of the market. December Bitcoin Performance and Volatility Another painful 30 days for Bitcoin (BTC-USD) with price falling (-9%) as volatility reached its highest levels (30-day Vol >45) since April 2025. The low of the print for Bitcoin came on November 22, when BTC traded around $80.7k, causing the 30-day RSI to bottom at around 32. The diminished appetite for speculation caused Bitcoin perpetual future basis rates to fall to (5%) annualized, while sagging as low as (3.7%) . This compares to the year’s average of (7.4%) . Most onchain metrics for Bitcoin were poor, with hash rate dropping (-1% m/m) , daily fees down (-14% m/m) in dollar terms, and new addresses stagnating at (-1% m/m) . Treasuries Accumulate While ETPs Retract A positive development in the last 30 days was an increase in the pace of BTC purchases by Bitcoin DATs (Digital Asset Treasuries). From mid-November to mid-December, DATs bought the dip, adding 42k (+4% m/m) BTC, bringing aggregate holdings to 1.09m BTC. This is the largest Bitcoin purchase by DATs since the period between July 16 and August 15, 2025, when DATs added 128.1k BTC (+15% m/m) to their total DAT holdings. With mNAVs dropping below 1.0x for many DATs, the majority of Bitcoin purchases in the past 30 days (29.4k BTC) were made by Strategy (MSTR), which can issue common stock to buy BTC because mNAV>1. Going forward, we believe many DATs’ strategy will be to move away from common stock issuance and instead finance BTC purchases with proceeds from preference share sales. For example, on December 22, 2025, the Japanese DAT Metaplanet will hold a shareholder vote to issue preferred stock to fund BTC purchases and operating expenses. Unfortunately, the BTC ETP investors were less bullish on Bitcoin with BTC holdings declining (-120bps m/m), dropping to 1.308m BTC. Longer-Term BTC Holders are Selling Tokens to New Holders Source: Glassnode as of 12/15/2025. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein. Divergent Behavior Between Long- and Medium-Term Holders Tracking the age of Bitcoins since they were last moved is an important indicator of hodler sentiment. Generally, if a token is not moved for a long time, greater than a few years, it indicates whoever holds it is confident in Bitcoin’s long-term prospects. When older tokens are moved, they instantly join the newest cohorts, and we believe this churn may signal a short/medium-term price peak. However, this measure is complicated because coins age into older cohorts at different rates due to changes in Bitcoin inflation and earlier movements by token holders. Also, many long-term holders may be rotating balances to take advantage of the security and liquidity offered by ETPs and DATs. Additionally, some holders may also be rotating addresses or moving to newer, more secure wallets. Looking at onchain, we see increased movement of medium-term tokens with deep reductions in the balances of 1-2yr (-900 bps m/m), 2-3yr (-1250 bps m/m), and 3-5yr (-550bps m/m) cohorts. Looking at longer-term token balances, older hodlers appear to be holding the line with slight changes: 5-7yr (+27bps m/m), 7-10yr (-18bps m/m), >10yr (+50bps m/m). If we step back and look more broadly at token balances older than 6 months, we have seen aggregate reductions (-190bps) in token balances. Thus, we see a nuanced picture in which the larger group of “long-term” holders, represented by coins that have not moved in the past 6 months, is reducing their balances. However, the longest-held coins do not appear to be following this trend, which means the oldest cohorts of hodlers are not selling. For the time being, we believe that short/medium-term cyclical players are dumping tokens while long-term Bitcoin bulls are holding. Breakeven Electricity Prices needed for S19 XP ASIC Source: Glassnode as of 12/15/2025. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein. Miner Profitability and Network Hash Rate Trends A looming issue facing Bitcoin is the sustainability of the Bitcoin mining complex. Bitcoin miners face a tough structural squeeze: Bitcoin’s block subsidy “halving” cuts revenue roughly every four years, even as network hash rate has compounded at about (+62%) CAGR since 2020. As a result, Bitcoin miners must continue to add hashing power through CAPEX to keep up with the network’s growth. To make mining profitable, Bitcoin’s price must make up for the reduction in supply and the growth of the hash rate. Recent weakness in the BTC price has made mining substantially less profitable, and a good indicator of this dynamic is the drop in breakeven electricity prices. In December 2024, the breakeven price on a 2022-era miner’s (S19 XP) electricity cost was around $0.12, and for December 2025 (through 12/15), this figure has fallen to $0.077. While Bitcoin hash has grown about 10x since 2020, it has been shrinking tactically over the past few months. Network hashing power, measured on a 30-day moving average, fell (-4%) over the past 30 days. This is the largest decline since April 2024. Bitcoin’s hashing rate reached an all-time high in early November, and we typically expect the rate to drop during large pullbacks in Bitcoin price. Recently, a host of factors have also been affecting the mining rate, including news that Chinese BTC miners in Xinjiang shut down 1.3 GW of capacity amid government scrutiny. This is likely due to shifting the power generation to AI demand and may result in the removal of up to 10% of Bitcoin network hashing power. It is estimated that nearly 400k mining machines have been shut down. While profitability for miners has been poor recently, many entities continue to mine despite periods of poor economics because they believe in Bitcoin's future. To support the long-term hash rate of the Bitcoin network, we believe up to 13 nations are mining with support from their central governments. Why a Falling Hash Rate Might Be Bullish Many Bitcoin enthusiasts worry about a sustained reduction in the hash rate because it could demonstrate that the mining industry is threatened as a going concern. Obviously, this would translate into people selling their BTC, thus worsening miner economics and therefore being reflexively bearish for Bitcoin price. Some empirical evidence suggests drops in hash rate can be bullish for long-term holders. Looking at 90-day forward BTC returns vs 30-day past changes in Bitcoin hashing rate since 2014, we find that forward returns are more likely to be positive when Bitcoin hash rate is shrinking than when it is growing ( 65% vs. 54% ). At the same time, we find that average 180-day forward returns are higher by around 30 bps (+20.5% vs 20.2%) when the Bitcoin hash rate is falling than when it is increasing. Going forward, we believe many DATs’ strategies will be to move away from common stock issuance and instead finance BTC purchases with proceeds from preference share sales. Additionally, when hash rate compression persists over longer periods, positive forward returns tend to occur more often and with greater magnitude. Across the 346 days since 2014, when the 90-day hash rate growth was negative, 180-day forward BTC returns were positive (77%) of the time, with an average return of (+72%) . Outside of those days, 180-day forward BTC returns were positive (~61%) of the time and averaged (+48%) . Thus, buying BTC when 90-day hash rate growth is negative, rather than at any time, has historically improved 180-day forward returns by (+2400 bps). Bitcoin ChainCheck Monthly Dashboard and Highlights 1 30 day change & 365 day change are relative to the 30-day avg, not absolute. Source: Glassnode, Bloomberg, Artemis XYZ as of 12/15/2025. Past performance is no guarantee of future results. Not intended as a recommendation to buy or sell any securities named herein. DISCLOSURES Definitions Bitcoin ( BTC ) is a decentralized digital currency, without a central bank or single administrator, that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries. Risk Considerations This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities, financial instruments or digital assets mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, tax advice, or any call to action. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results, are for illustrative purposes only, are valid as of the date of this communication, and are subject to change without notice. Actual future performance of any assets or industries mentioned are unknown. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its other employees. The information, valuation scenarios and price targets presented on any digital assets in this blog are not intended as financial advice, a recommendation to buy or sell these digital assets, or any call to action. There may be risks or other factors not accounted for in these scenarios that may impede the performance these digital assets; their actual future performance is unknown, and may differ significantly from any valuation scenarios or projections/forecasts herein. Any projections, forecasts or forward-looking statements included herein are the results of a simulation based on our research, are valid as of the date of this communication and subject to change without notice, and are for illustrative purposes only. Please conduct your own research and draw your own conclusions. Past performance is not an indication, or guarantee, of future results. Hypothetical or model performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading, and accordingly, may have undercompensated or overcompensated for the impact, if any, of certain market factors such as market disruptions and lack of liquidity. In addition, hypothetical trading does not involve financial risk and no hypothetical trading record can completely account for the impact of financial risk in actual trading (for example, the ability to adhere to a particular trading program in spite of trading losses). Hypothetical or model performance is designed with benefit of hindsight. Index performance is not representative of fund performance. It is not possible to invest directly in an index. Investments in digital assets and Web3 companies are highly speculative and involve a high degree of risk. These risks include, but are not limited to: the technology is new and many of its uses may be untested; intense competition; slow adoption rates and the potential for product obsolescence; volatility and limited liquidity, including but not limited to, inability to liquidate a position; loss or destruction of key(s) to access accounts or the blockchain; reliance on digital wallets; reliance on unregulated markets and exchanges; reliance on the internet; cybersecurity risks; and the lack of regulation and the potential for new laws and regulation that may be difficult to predict. Moreover, the extent to which Web3 companies or digital assets utilize blockchain technology may vary, and it is possible that even widespread adoption of blockchain technology may not result in a material increase in the value of such companies or digital assets. Digital asset prices are highly volatile, and the value of digital assets, and Web3 companies, can rise or fall dramatically and quickly. If their value goes down, there’s no guarantee that it will rise again. As a result, there is a significant risk of loss of your entire principal investment. Digital assets are not generally backed or supported by any government or central bank and are not covered by FDIC or SIPC insurance. Accounts at digital asset custodians and exchanges are not protected by SPIC and are not FDIC insured. Furthermore, markets and exchanges for digital assets are not regulated with the same controls or customer protections available in traditional equity, option, futures, or foreign exchange investing. Digital assets include, but are not limited to, cryptocurrencies, tokens, NFTs, assets stored or created using blockchain technology, and other Web3 products. Web3 companies include but are not limited to, companies that involve the development, innovation, and/or utilization of blockchain, digital assets, or crypto technologies. All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance. © Van Eck Associates Corporation. Original Post